Help

Search Results

Yes. If you would like to apply using the paper application, contact LaCrosse School District ((785) 222-2505 / hshowalter@usd395.org / Box 778 La Crosse, KS 67548-0778) to request an application. Then return the completed application to LaCrosse School District.

Yes. Eligibility for free or reduced price meals only lasts for one school year. However, eligibility for the previous year carries over for the first few days of the school year, or until the new eligibility determination is made, whichever occurs first. Please complete a new application unless you received a letter from the school saying that your child is eligible for the upcoming 2025 - 2026 school year.

No. Use one Free and Reduced Price School Meal Application for all students that attend school in LaCrosse School District in your household.

No, but please read the letter carefully. If any children in your household were missing from your eligibility notification letter, they may also be eligible for free meals, so you should contact LaCrosse School District ((785) 222-2505 / hshowalter@usd395.org / Box 778 La Crosse, KS 67548-0778) immediately.

Yes, you may apply at any time during the school year. For example, children with a parent or guardian who becomes unemployed may become eligible for free or reduced price meals if the household income drops below the income limit.

All children in a household are eligible for free meals when at least one household member is receiving benefits from Food Assistance, the Food Distribution Program on Indian Reservations (FDPIR), or Temporary Assistance for Families. If you participate in other assistance programs, contact LaCrosse School District to see if you qualify for school meal benefits. You may qualify for free meals!

Foster children who are formally placed by the State welfare agency or court in a caretaker household are eligible for benefits regardless of household income.

Participation in the Special Supplemental Nutrition Program for Women, Infants and Children, or WIC program, does not automatically qualify your children for free or reduced price school meals. You will need to qualify based on your household income by completing this application.

Children enrolled in Head Start are automatically eligible for free meals. You do not need to submit an application for school meal benefits unless you are requesting benefits for other school age children in your household.

To find out how to apply for Food Assistance (FA) or other assistance benefits, contact your local assistance office or call 1-888-369-4777.

Yes. You, your children, or other household members do not have to be U.S. citizens to apply for free or reduced price meals.

No, the non-cash benefits received through the National School Lunch Program and School Breakfast Program are not subject to public charge consideration. In other words, you will not be deported, denied entry to the country, or denied permanent status because you apply for or receive school meal benefits.

Yes, each application is reviewed by the district to determine eligibility. We may also ask you to send proof of your household’s income.

If you have this information handy, it will make the application process fast and easy.

- If you participate in FA, TAF, FDPIR you will need to know your case number (not your card or account number).

- If you do not participate in any of the above assistance program, you will need to report your total household income. In that case…

- If anyone in your household has a job, you may need to reference the earnings statements or pay stubs to report your gross income, which is different than the amount in your paycheck.

- If anyone receives Social Security or retirement benefits, you may need to gather the benefit statements to report the amount and frequency of the payments.

- You may also need to reference other financial documents for additional sources of income.

Still not sure if you have everything you need? Don’t worry. The income section of the application contains detailed instructions and explanations about the sources of income you must include, and you can gather additional information then.

A household is defined as a group of people, related or unrelated, that usually live together and share income and expenses.

Don't forget to include people if you support them financially, regardless of whether they earn or receive income, including:

- Foster children

- Children that are away at college or boarding school

- Grandparents

- Extended family members that are living with you

- Foreign exchange students that are living with you

- People that are not currently living with you, but are only away on a temporary basis (like kids that are away at college)

- Family members of the armed services who are away from home because they are activated or deployed

- People living away from home for an extended period of time (such as parents who live and work away from home)

- Other people who stay at your house and you provide with shelter, utilities, clothing, or food

You should NOT include:

- Renters

- Boarders

- Children who do not live with you (such as children that live permanently with other relatives or friends)

- Children for whom you do not have custody and therefore do not live with you (if you have joint custody, see the help question: WHAT IF I SHARE CUSTODY OF MY CHILD?

If time is split between houses, both parents may apply for benefits. If the eligibility statuses are different, the highest level of benefits will apply. For example, if you qualify for free meals but your child’s other parent does not, no matter which house your child is staying at, he or she can still receive free meals. However, if either parent chooses not to have your child receive free meal benefits while residing with them then that parent may simply pay for the meals.

Yes. Members of the armed services who are activated or deployed are counted as household members. Any money made available by them or on their behalf for the household is included as income to the household with the exception of Combat Pay.

No. The foster status only applies to children who are formally placed by the State welfare agency or court in a caretaker household. It does not apply to informal arrangements, such as caretaker arrangements or to permanent guardianship placements, which may exist outside of State or court based systems. The child may still be eligible based on your household income, so we encourage you to complete an application.

Congratulations on the adoption! And the answer is maybe. If your child was approved for free meals before the adoption went through, then your child is eligible to receive free meals for the rest of the school year. But next year the child will no longer be eligible for free meals based on foster status, though they may still qualify based on household income, so we encourage you to submit an application.

Your children may qualify as a migrant if you have moved your household into a different school district within the last three years to gain or look for temporary/seasonal work in agriculture or fishing.

If you believe children in your household meet one or more of these descriptions and you haven’t been told your children will get free meals, please contact LaCrosse School District.

Your children may qualify as homeless if they…

- are sharing the housing of other persons due to loss of housing, economic hardship, or a similar reason, or are living in motels, hotels, trailer parks, or camping grounds due to the lack of alternative adequate accommodations;

- are living in emergency or transitional shelters, are abandoned in hospitals, or are awaiting foster care placement;

- have a primary nighttime residence that is a public or private place not designed for or ordinarily used as a regular sleeping accommodation for human beings; or

- are living in cars, parks, public spaces, abandoned buildings, substandard housing, bus or train stations, or similar settings.

If you believe children in your household meet one or more of these descriptions and you haven’t been told your children will get free meals, please contact LaCrosse School District.

Any children living with you who have chosen to leave their prior family or household may qualify for free meals. Please contact LaCrosse School District.

The income section of this application will ask about the money received on a regular basis from the following sources:

- Military basic pay and drill pay

- Military cash bonuses

- Military allowance for off-base housing, food, clothing (BAH)

- Military benefits

- Salary

- Wages

- Tips

- Commissions

- Cash bonuses

- Income for the self-employed

- Income from wages and self-employment

- Strike benefits

- Projected Income for seasonal workers

- Supplemental Security Income (SSI)

- Veteran’s benefits

- Cash assistance from State or local government

- Housing subsidies (not including those from Federal housing programs)

- Alimony received

- Child support received

- Adoption assistance

- Unemployment benefits

- Worker’s compensation

- Social Security Disability Insurance (SSDI)

- Social Security

- Black Lung benefits

- Railroad retirement

- Pensions

- College financial aid for room and board (living expenses), not including Pell Grants, Supplemental Education Opportunity Grants, State Student Incentive Grants, National Direct Student Loans, PLUS, College Work Study, or Byrd Honor Scholarship Programs

- Regular cash payments from outside the household (for example, money regularly received from extended family or friends that do not live in the household)

- Regular payments or withdrawals from sources such as an award, settlement, inheritance, or prize winnings

- Net income from rental properties

- Earned interest

- Annuities

- Other investment income

- Any other money that may be available to pay for children’s meals

We do not take into account income from:

- Irregular overtime pay

- Military Family Substance Supplemental Allowance (FSSA)

- Military Housing Privatization Initiative (MHPI)

- Combat Pay when it is:

-

- Received in addition to the service member’s basic pay;

- Received as a result of deployment to or service in an area that has been designated as a combat zone; and

- Not received by the service member prior to deployment to or service in the designated combat zone

- Cash value of benefits from FA or FDPIR

- Payments received from a foster care agency or court for the care of foster children

- Student financial assistance provided for the costs of attendance at an educational institution, such as grants and scholarships awarded to meet educational expenses and not available to pay for meals

- Loans, such as bank loans, since these funds are only temporarily available and must be repaid

- Earnings received on an irregular basis, such as payment for occasional baby-sitting or mowing lawns

- Housing subsidies from Federal housing programs

Child income is money received from outside your household that is paid directly to your children. Many households do not have any child income.

Gross income is all money earned before deductions, such as income taxes, employee’s social security taxes, and insurance premiums. Gross income also includes money that is garnished from wages, or in the case of bankruptcy, income that is ordered to be paid to creditors.

Commonly referred to as “take home pay,” net income is the amount of money you receive in your pay check. It is your total (or gross) income, minus taxes and deductions.

If your income is different this month than a normal month because of overtime, holiday pay, missing a couple of shifts at work, or some other reason, put down what you would have made if those things hadn’t happened. For example, if you normally make $1000 each month, but you missed some work last month and only made $900, put down that you make $1000 per month. Similarly, if you normally make $500 per month, but you worked overtime and made $750, put down that you make $500 per month.

- If you work on a seasonal basis, like in agriculture or tourism, and earn more money in some months than in other months, you may want to report your income on an annual basis. If you expect to earn the same amount as last year, you can use your earnings from last year as the basis of your projected monthly income.

- If you receive a one-time payment, it should not be reported as current, monthly income since it is not received on a regular basis. However, if you receive a one-time payment, such as from an award, settlement, inheritance, or prize winnings, and then regularly draw on that money for living expenses later on, the amount withdrawn should be reported in your application for school meal benefits.

- If you need additional help or information about how to report your income, contact LaCrosse School District (785) 222-2505 / hshowalter@usd395.org / Box 778 La Crosse, KS 67548-0778, and they will help you figure out your household’s annual rate of income based on USDA guidelines.

Your basic pay and cash bonuses must be reported as income. If you get any cash value allowances for off-base housing, food, or clothing, (including BAH), it must also be included as income. However, if your housing is part of the Military Housing Privatization Initiative, do not include your housing allowance as income. Do not include payments from the Family Subsistence Supplemental Allowance (FSSA). Any additional Combat Pay resulting from deployment is also excluded from income. If the service member is deployed, include only the portion that is made available by them or on their behalf to the household as income.

No, as long as the following conditions are met:

- It was received in addition to basic pay;

- It was received for the deployment to or service in an area designated as a combat zone; and

- It was not received prior to deployment to or service in the designated combat zone.

If any of these conditions are not met, you should report the amount as military basic pay.

Maybe. If you are not deployed, then it is included in your household income, but if you are away from your home station, then you are exempt from including it as household income.

Family Subsistence Supplemental Allowance (FSSA) is available to service members living in overseas locations whose income is less than 130 percent of the federal poverty line, and benefits equal the total dollars required to bring household income to that level.

A salary is an agreed-upon, fixed amount of money paid to an employee every year. Employers pay salaries in different frequencies depending on the work, but often the frequency is monthly, twice a month, or every two weeks. Wages are also an agreed-upon payment for work. Employers usually pay wages at an hourly, daily or weekly frequency.

If you are self-employed, report income from work as a net amount. This is calculated by subtracting the total operating expenses of your business from its gross receipts or revenue. For more information see the definition for ‘Net income from self-employment’.

For a household with income from wages and self-employment, each amount must be listed separately. When there is a business loss, income from wages must not be reduced by the amount of the business loss. If income from self-employment is negative, you should report it as $0 (zero) on your application.

If you have questions about whether to include benefits from a specific program, contact LaCrosse School District ((785) 222-2505 / hshowalter@usd395.org / Box 778 La Crosse, KS 67548-0778).

If you receive income from a room or property that you rent out, you should report the net amount of income. In other words, take the total amount you receive in rent for one month (the gross income), and subtract the monthly cost of maintaining the property. If you have questions or need help figuring out how to estimate maintenance costs, contact LaCrosse School District ((785) 222-2505 / hshowalter@usd395.org / Box 778 La Crosse, KS 67548-0778).

If you have money in a savings or investment account, you should have income from earned interest. Interest payments are usually paid out on a quarterly basis, or four times per year. You should see any earned interest on your savings or investment account statement.

If you work on a seasonal basis and your household’s current, gross income is higher or lower than usual and does not fairly or accurately represent your household’s actual circumstances, see the ‘WHAT IF MY INCOME IS NOT ALWAYS THE SAME?’ question in the HELP. If you have additional questions, contact LaCrosse School District ((785) 222-2505 / hshowalter@usd395.org / Box 778 La Crosse, KS 67548-0778), and they will help you figure out your household’s annual rate of income based on USDA guidelines.

You should still list these household members on your application. Household members may not earn or receive some of the types of income we ask you to report, or they may not receive income at all. Remember, your eligibility determination is based on both household income and household size. For more information on who to include in your application, see “WHO SHOULD I INCLUDE IN MY HOUSEHOLD?”

Don’t worry, you don’t need to have a Social Security number to receive free or reduced price meal benefits.

No, but it is very helpful to have your contact information in case we need to get in touch with you about your application. Also, if your contact information changes in the future, please let us know so that we can maintain up-to-date information for your household throughout the year.

You should talk to school officials. You also may ask for a hearing by calling or writing to LaCrosse School District ((785) 394-2433 / jirvin@gbta.net / Box 778 La Crosse, KS 67548-0778).

Definitions

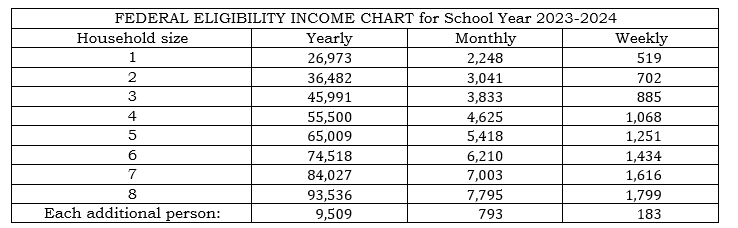

Children may receive free or reduced price meals if your household’s income is within the limits on the Federal Income Eligibility Guidelines. Your children may qualify for free or reduced price meals if your household income falls at or below the limits on this chart.

McKinney-Vento Education of Homeless Children and Youth Assistance Act provides Federal money for homeless shelter programs and facilitates public school access for homeless children and youth.

MEP provides services to children who have moved across school district lines, within the last three years, in order to accompany or join a parent or guardian who seeks or obtains temporary or seasonal work in agriculture or fishing.

Runaway and Homeless Youth Act authorizes community-based runaway and homeless youth projects to provide temporary shelter and care to runaway or otherwise homeless youth who are in need of temporary shelter, counseling, and aftercare services.

Current income is income earned or received in the current month, or in the month before the completion of this application.

A cash bonus is a lump sum of money awarded to an employee, either occasionally or periodically.

Income from self-employment should be reported as your current net income, equal to gross revenue (income) minus business expenses. Gross revenue (income) includes the total income from goods sold or services rendered by the business, or the value of all products sold.

- Deductible business expenses include the cost of goods purchased; rent; utilities; depreciation charges; wages and salaries paid; and business taxes;

- Non-deductible business expenses include the value of salable merchandise used by the proprietors of retail businesses; and personal, Federal, State, or local income taxes;

- Net income for self-employed farmers is figured by subtracting the farmer’s operating expenses from the gross revenue (income). Gross income includes money received from the rental of farm land, buildings, or equipment to others; and incidental receipts from the sale of items such as wood, sand, or gravel. Operating expenses include cost of feed, fertilizer, seed, and other farming supplies; cash wages paid to farmhands; depreciation charges; cash rent; interest on farm mortgages; farm building repairs; and farm taxes;

If your current net income is not your usual income, you may use last year’s income as a basis to report net income, or refer to the question ‘WHAT IF MY INCOME IS NOT ALWAYS THE SAME?’ in the HELP.

Supplemental Security Income (SSI) provides cash to meet basic needs for food, clothing, and shelter to aged, blind, and disabled people who have little or no income.

Income in the form of cash benefits, including housing assistance, from state or local government programs should be reported as household income. If you have questions about whether to include benefits from a specific program, contact LaCrosse School District ((785) 222-2505 / hshowalter@usd395.org / Box 778 La Crosse, KS 67548-0778).

Alimony is income from payments paid by a spouse or former spouse from whom you are divorced or legally separated.

Child support payments are payments received by one parent from another to cover the cost of raising a child.

Unemployment benefits are payments from the government or a labor union to a person who is unemployed.

Worker’s compensation benefits are payments to cover lost wages and medical expenses of an employee who is injured on the job.

Strike benefits are compensation paid by a union to workers on strike.

Social Security Disability Insurance (SSDI) are benefits paid to people who have worked long enough and paid Social Security taxes but who can’t work because they have a medical condition that is expected to last at least one year or result in death.

Benefits that are paid to veterans who have a service-connected disability and were not dishonorably discharged.

Social Security retirement benefits are monthly payments to people (or spouses, or dependent children of people) who are retired or disabled, but have worked and paid taxes into the Social Security system. Payments are based on your reported earnings. Also, upon death, survivors can collect benefits.

Black Lung benefits provide monthly payments and medical treatment for people that became disabled from black lung disease from working in or around the nation’s coal mines.

Railroad retirement benefits provide retirement and disability annuities for qualified railroad employees, spouse annuities for their wives or husbands, and survivor benefits for the families of deceased employees who were insured under the Railroad Retirement Act.

Regular cash payments from outside the household is money regularly received from extended family or friends that do not live with you. For example, if parents or grandparents regularly help cover the cost of groceries, bills, or rent, that money is considered household income and should be reported in your application for school meal benefits.

One-time payments should not be reported as current, monthly income since they are not received on a regular basis. However, if you receive a one-time payment, such as from an award, settlement, inheritance, or prize winnings, and then regularly draw on that money for living expenses later on, the amount withdrawn should be reported in your application for school meal benefits in the space for ‘Any other income available to pay for children’s school meals’.

A pension is generally a series of payments made to you after you retire from work. Pension payments are made regularly and are based on such factors as years of service and prior compensation.

An annuity is a series of payments under a contract made at regular intervals over a period of more than one full year. They can be either fixed (under which you receive a definite amount) or variable (not fixed). Annuities can be purchased by individuals alone, or with the help of an employer.

A trust is, in general, a relationship in which one person holds title to property, subject to an obligation to keep or use the property for the benefit of another.

Supplemental Security Income (SSI) provides cash to meet basic needs for food, clothing, and shelter to children younger than age 18 who have a physical or mental condition, or combination of conditions, that meets Social Security’s definition of disability for children, and if his or her income and resources fall within the eligibility limits.

Social Security benefits are monthly payments to children of a deceased, retired, or disabled parent who worked and paid taxes into the Social Security system.

A child may receive payments from a pension of a deceased parent.

A child may be the recipient of payments from an annuity. An annuity is a series of payments under a contract made at regular intervals over a period of more than one full year. They can be either fixed (under which you receive a definite amount) or variable (not fixed). Annuities can be purchased by individuals alone, or with the help of an employer.

If you have any questions about the program or how to apply, contact LaCrosse School District ((785) 222-2505 / hshowalter@usd395.org / Box 778 La Crosse, KS 67548-0778).